How Predictive Analytics is Revolutionizing Insurance Fraud Detection in 2025

In 2025, the fight against insurance fraud has entered a new era, driven not just by automation, but by the precision of predictive analytics. Traditional rules-based systems, while still in use, are rapidly being outpaced by advanced statistical modeling, real-time data pipelines, and machine learning algorithms capable of identifying fraud patterns before they materialize.

From supervised models that flag anomalies based on historical claims behavior to unsupervised techniques uncovering hidden fraud rings, insurers are now deploying predictive analytics as a proactive defense layer. This shift is transforming fraud detection from a reactive, manual process into a data-driven, AI-augmented capability that adapts in real time, reducing false positives, accelerating investigations, and protecting both the bottom line and customer trust.

Why is Predictive Analytics Important in Insurance?

- Improved Risk Management: Analyze behavioral and historical data to more accurately assess policyholder risk.

- Customer-Centric Experience: Personalize policies, pricing, and communication based on predictive models.

- Fraud Detection and Prevention: Spot suspicious claims before they escalate into payouts.

- Heightened Operational Efficiency: Automate claim routing, fraud alerts, and underwriting tasks using AI models.

How Predictive Analytics in Insurance Works

Predictive analytics transforms historical data into actionable insights using AI and machine learning. Through advanced dashboards, data mining, and risk modeling, insurers can visualize trends, identify anomalies, and take preventive actions, especially in fraud detection. For instance, AI can flag a claim based on unusual timing, payout amount, or past behavior, prompting human review before processing.

Emerging Trends in Predictive Analytics in Insurance

The predictive analytics landscape in insurance is evolving rapidly in 2025, driven by generative AI, IoT data streams, and customer behavior models.

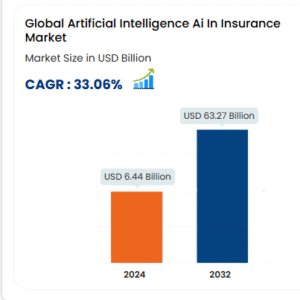

As cited by databridgemarketresearch, the global artificial intelligence (AI) in insurance market was valued at USD 6.44 billion in 2024 and is expected to reach USD 63.27 billion by 2032.

During the forecast period of 2025 to 2032, the market is likely to grow at a CAGR of 33.06%, primarily driven by advancements in predictive analytics.

This growth is driven by factors such as better risk assessment & pricing, IoT integration and faster claims processing.

Companies in the U.S. and Canada are leveraging machine learning, natural language processing, and predictive analytics to enhance customer experience and operational efficiency.

The use of predictive analytics and modeling is also expected to rise notably, with 22% of organizations planning to adopt this technology over the next two years.

(Source: Anti fraud technology benchmarking report, 2024)

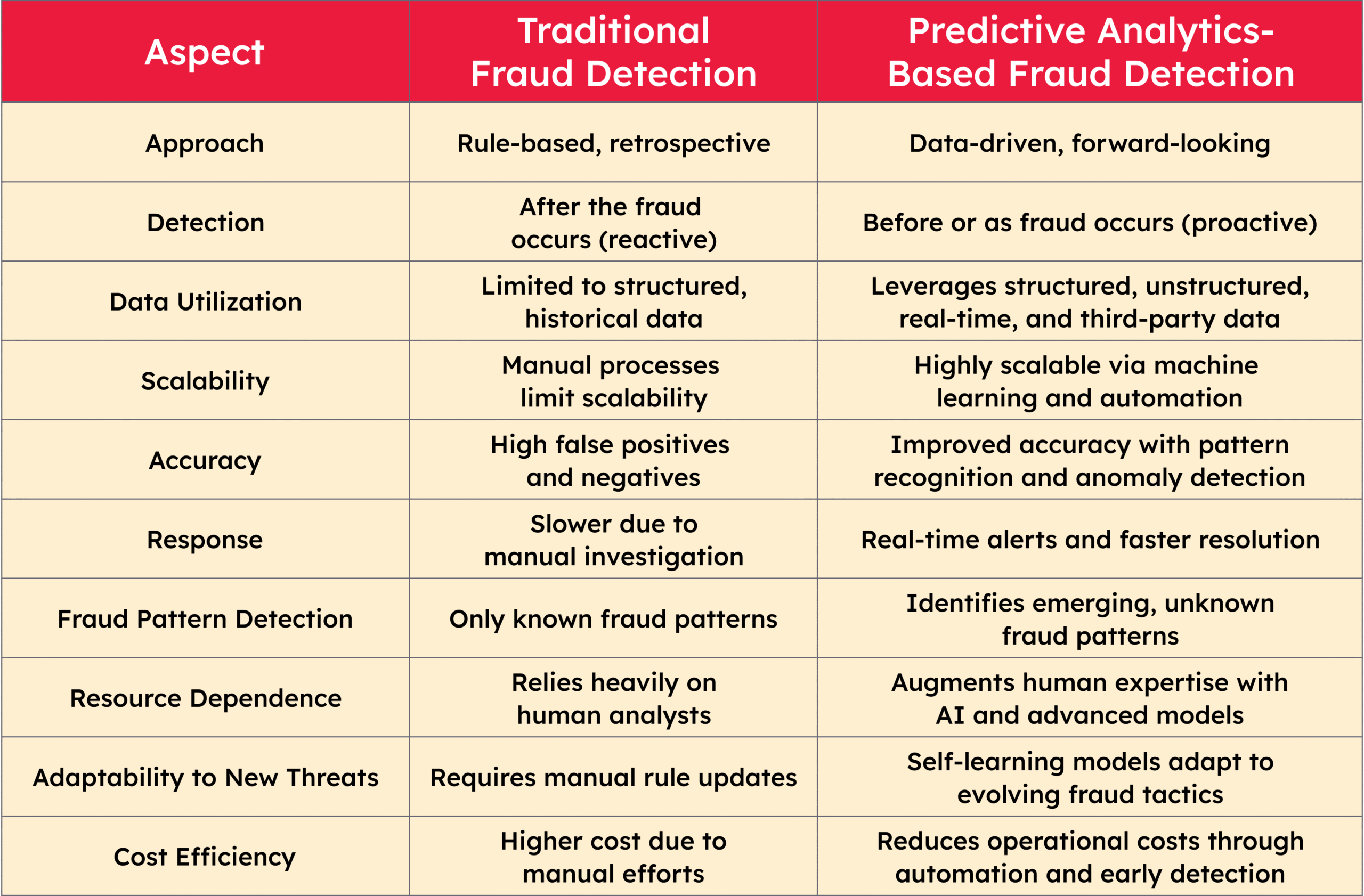

Traditional VS Predictive Analytics-Based Fraud Detection

While traditional methods still play a role, predictive analytics empowers insurers to detect and prevent fraud with greater speed, precision, and efficiency, turning data into a powerful shield.

Implementation Challenges of Using Predictive Analytics in Insurance Fraud Detection

Data Quality and Integration

What predictive models need is clean, consistent, and comprehensive data, but what insurers have is incomplete claims history, poor data labeling, outdated and siloed systems, and legacy platforms that reduce model accuracy and increase false positives.

Lack of Historical Fraud Data

Training predictive models requires high-quality fraud cases for supervised learning. But due to limited fraud history or inconsistent documentation, inadequacies occur during model training, leading to weak predictive performance.

Evolving Fraud Tactics

Fraudsters frequently change their patterns and exploit new vulnerabilities while adapting to detection methods. Static or outdated models often struggle to identify emerging or sophisticated fraud schemes, leading to inaccuracies.

Regulatory and Compliance Concerns

Predictive analytics tools must align with industry regulations like GDPR or HIPAA compliance to play a transparent and fair role in decision-making. However, this is not always the case, and rejection of certain AI techniques may result in delay.

Organizational Readiness

Implementing predictive analytics is as much about technology as it is about people and processes. Many insurers lack the talent and analytical culture needed to drive adoption of tools.

High Initial Investment

Building a predictive fraud detection system involves costs. Data infrastructure, tools, skilled talent, and ongoing model training and monitoring require a high initial investment and justify ROI in the short term.

Ever-changing IP address

With tools like TOR (The Onion Router) and VPNs, fraudsters can easily change their IP addresses and locations, making it difficult for systems to detect their true whereabouts.

Predictive Analytics for Fraud Detection and Prevention – Process

Predictive Analytics Techniques to Use for Fraud Detection

- Logistic regression: Logistic regression is a statistical technique commonly used in predictive analytics to classify outcomes, such as whether a claim is fraudulent or legitimate. It’s best suited for binary classification problems.

Use Case: A claim with a high payout amount, submitted shortly after the policy was purchased, and lacking supporting documentation might receive a fraud probability score close to 1 (i.e., high likelihood of fraud). Claims above a certain threshold (e.g., 0.8) can then be flagged for manual review or automated investigation.

The model assigns weights to variables such as:- Claim amount

- Time to report

- Claimant’s historical behavior

- Type of claim

- Claim amount

- Decision tree: Decision trees are rule-based models that build a hierarchical structure to identify conditions most likely to lead to fraud. Each node represents a feature condition, and each branch represents a decision outcome, making the model highly interpretable.

Use Case: Insurers can use decision trees to create “if-then” rules like:

If the claim type is bodily injury AND the report was delayed > 30 days → High fraud risk.

Best for: Explainable models in claim approval workflows or when interpretability is key for compliance. - Neural Networks: Neural networks are inspired by the structure of the human brain and excel at recognizing complex, non-linear relationships in large datasets. They can adapt to patterns over time and are effective for image analysis, text interpretation, or multi-layered behavioral fraud signals.

Use Case: In motor insurance, a neural network can analyze vehicle damage photos, policyholder history, and claim details to detect discrepancies or manipulated evidence.

Best for: Use cases involving unstructured data like images or notes, and large datasets with hidden patterns. - Ensemble Methods: Ensemble techniques combine multiple models to boost prediction accuracy and minimize overfitting. The two most common approaches are bagging and boosting.

Bagging (Bootstrap Aggregating):- Trains multiple models on random subsets of the data.

- Aggregates their outputs to reduce variance and prevent overfitting.

- Example: Random Forests are a bagging method often used in insurance fraud scoring.

- Trains multiple models on random subsets of the data.

Conclusion: Insurance companies have traditionally been cautious about adopting analytics due to concerns over high implementation costs and a shortage of skilled talent. However, evidence shows that analytics plays a critical role in proactively detecting fraud early in the insurance lifecycle, significantly reducing the cost of fraud management and enhancing the overall return on investment (ROI) of fraud prevention solutions.

To stay ahead, insurers must harness the full potential of their data, whether structured or unstructured, by leveraging analytics to detect, manage, and report fraudulent activity more effectively.

Faster fraud detection enables better fraud prevention!1

Want to explore how predictive AI can transform your fraud detection strategy?2

Connect with our insurance analytics expert today: